Last Updated on March 16, 2024 by Treana Wunsch

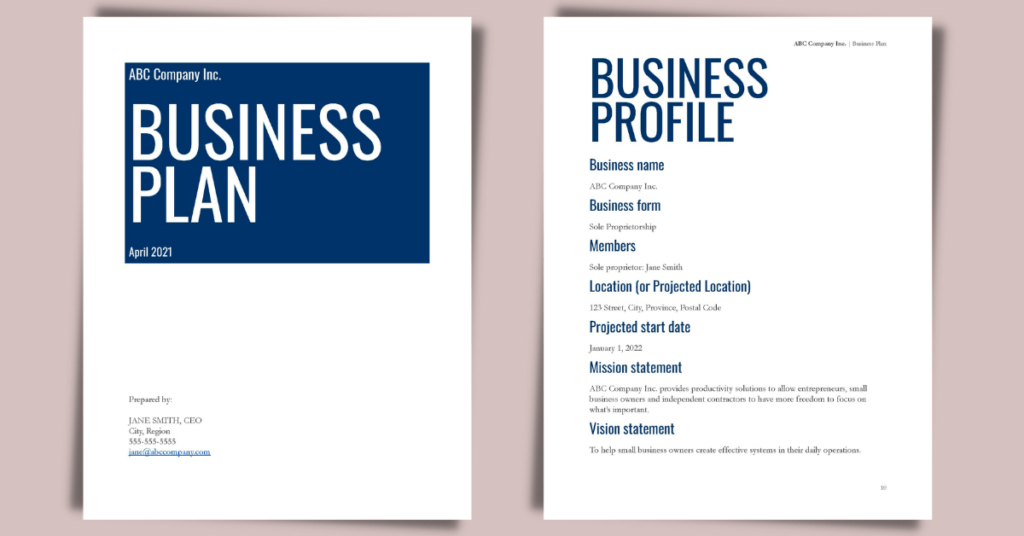

The Business Profile section is a summary of the framework of your business. The intention is to give an overall picture of the specifics of the business. Even though the business profile section should only be about a page long there are a lot of decisions that need to happen first. It can be in point form and it should include the following:

- Business Name

- Legal form of business

- Members

- Location (or projected location)

- Projected start date

- Mission statement

- Vision statement

- Objectives

Business Name

The business profile is where you put the registered or proposed business name. Deciding on a business name can be one of the most difficult aspects of starting a business. The right name can directly impact the success of your business. It could end up being one of the most valuable assets of your business.

At this point, you may be wondering, how do I choose a good business name?

So, you’ve decided to start a small business. Congratulations! This is a huge accomplishment. The next step is to choose a great business name. Choosing a great business name is essential to the success of your business. It’s the first thing potential customers will see and how they remember you.

The right name can help you to build trust, establish credibility, and attract customers. It will also make you memorable. The wrong name can destroy all of that. The right name is one that’s available in the market and matches your mission.

What feelings or emotions do you want to convey to your potential customers? Perhaps, you want to communicate that your company can bring stress relief or a sense of calm. Or maybe you want them to feel excited and energetic. This is the first thing you should decide. I would suggest creating a document and brainstorming ideas.

The name should be short, easy to spell, easy to pronounce and easy to remember. Using a play on words can help make the name memorable. Keep in mind your target market and what they would think is memorable or clever. People should be able to figure out what type of business it is by the name. For example, The Container Store.

The name should have as few words as possible. One word is best. For example, Tesla. However, it’s hard to convey what the business is in only one word.

Do some research and notice other business names. Which ones do you like and why? Which ones are terrible and why? Keep all of this research in your research folders as discussed in the first post in this series. You can even discuss the names you like with family and friends to see what they think. However, don’t ask them if they like the names or not, ask them how the names make them feel or what they think about when they see the name.

Once you have a few names chosen, you’ll want to do an internet search to make sure they aren’t taken. Keep in mind you will most likely want the domain to match the name. Once you’re confident nobody else is using the name, you can register it in your region or federally if you will be conducting business around the country.

If you’re having trouble deciding on a name but need to register your business, use your own name until you decide.

Legal Form of Business

One of the first decisions you must make when starting your business is the legal form your business will take. It can sometimes be a difficult decision but don’t worry, you can change it later. The Business Profile section is where you want to slot this information.

How to choose the best legal form of business for your new small business

Sole proprietorship

A sole proprietorship is owned by one individual. It is not a corporation. There is no legal separation between the individual and the business. It is common for consultants, freelancers and one-person businesses to choose this form.

All control, responsibility and decision-making falls to that one individual. Financial losses and gains are claimed by the owner. All income is claimed through personal income tax.

If you’d like to operate under a business name other than your name, you’ll have to register the name and open a separate business bank account under that name.

Pros:

- Owner has complete control over business

- Cheapest, fastest and easiest form of business to get into

- Owner receives all profit

- No incorporation records to file

- No separate tax return

Cons:

- All liability falls to the owner

- All decisions and responsibilities fall to the owner

- Harder to raise capital and long-term financing

- When the owner dies, the business dies

- Higher tax rate

Partnership

A partnership is owned by two or more individuals or corporations. It is not a corporation in and of itself. There is no legal separation between the partners and the business. All control, responsibility and decision-making fall to each partner. The roles of each partner are outlined in a partnership agreement. This can be a verbal agreement or a written agreement. It can be written up by a lawyer if you wish. Financial losses and gains are claimed by each owner in the percentage outlined in the partnership agreement.

The name of the partnership will automatically be the last name of the partners. If you’d like to operate under a business name other than that, you’ll have to register the name (this will be addressed later in the book). It is not necessary to open a separate bank account for a partnership but I would recommend it. This will make keeping the finances easier and more transparent. All income and expenses can filter through the partnership account to be divided later.

Pros:

- Shared knowledge, control and responsibility

- Shared financial burden

- Owners receive all profit

- Larger business network

- Support

Cons:

- Not all decisions are yours

- Potential for disagreements

- Profit is divided

- Harder to raise capital and long-term financing

- No separate business entity to invest in and potentially sell

Corporation

A corporation is a separate legal business entity owned by one or more shareholders. It is not a corporation in and of itself. There is no legal separation between the partners and the business. All control, responsibility and decision-making fall to each partner. The roles of each partner are outlined in a partnership agreement. This can be a verbal agreement or a written agreement. It can be written up by a lawyer if you wish. Financial losses and gains are claimed by each owner in the percentage outlined in the partnership agreement.

The name of the partnership will automatically be the last name of the partners. If you’d like to operate under a business name other than that, you’ll have to register the name (this will be addressed later in the book). It is not necessary to open a separate bank account for a partnership but I would recommend it. This will make keeping the finances easier and more transparent. All income and expenses can filter through the partnership account to be divided later.

Pros:

- Shared knowledge, control and responsibility

- Shared financial burden

- Owners receive all profit

- Larger business network

- Support

Cons:

- Not all decisions are yours

- Potential for disagreements

- Profit is divided

- Harder to raise capital and long-term financing

- No separate business entity to invest in and potentially sell

How to choose:

- If you’re having trouble deciding which legal business form to choose, ask yourself these questions:

- Do I want to keep the business small and simple?

- Will the business always (or for the unforeseeable future) be operated by myself only?

- Am I comfortable with taking on all liability of the business?

- Am I undecided about building the business beyond myself?

- Am I confident that clients will trust in my business without the ‘corporation’ label?

- Am I starting a business that has low liability concerns?

- Will my startup costs be low?

If you answered ‘yes’ to all of these questions, it’s safe to say that a sole proprietorship is the right way to go. You can always change it later if your business changes. It will be more complicated and cost more but you’ll also be more experienced and will have more income down the road so you can save time and money upfront.

A partnership would be appropriate if you answered ‘yes’ to the questions above but will be going into business with one or more partners.

- Do I have plans to build the business beyond myself in the near future?

- Do I want to be able to invest in my business and sell it later?

- Do I want to enhance my business’ credibility?

- Do you want to protect your personal assets?

- Do you need to have easier access to capital?

If you answered yes to any of these questions, you may want to consider incorporating the business.

If you’re still unsure of which legal business form to choose, you may want to consider consulting a lawyer so you can include this in the business profile.

Members

In the business profile section, you will need to list the business members, their share of the business and their role. See examples in the Business Plan Template. Some examples are:

Shareholder: Treana Wunsch (100%)

or

Shareholder: Jane Doe (51%)

Shareholder: John Doe (49%)

Location or Projected Location

You’ll also need to include the location or projected location of the business in the business profile. The location of your business will be determined by the type of business you are starting, the size of your business, and your budget. If you are starting a brick-and-mortar business, you will need to choose a location that is visible and accessible to your target market.

Your budget will also play a role in choosing a location for your small business. If you have a limited budget, you may need to start with a smaller space or look for locations that offer lower rent prices. Once you have considered all of these factors, you can begin narrowing down your search for the perfect location for your small business.

If you don’t have a location by the time you write the business profile section of your business plan, it’s a good idea to include the projected business location in order to show potential investors that you’ve researched the costs, and understand how important the location can be for a business.

If it is a home-based business, use your home address.

Projected Start Date

Include your projected start/launch date in the business profile. Be sure to research how long everything you’ve planned will take. Run through everything and add on 10% for time contingency. Hint: Everything will take longer than you plan. Here are some tips to help you choose the right projected start date for your business:

1. Consider your funding. If you’re seeking funding from investors or lenders, they’ll want to know when you expect to start generating revenue. Choose a date that gives you enough time to get your business up and running, but isn’t so far in the future that it looks like you’re not serious about starting your business.

2. Think about your timeline. Once you have a projected start date in mind, think about what needs to happen between now and then in order to make your business a reality. If you need to raise money, that could take a while. If you’re looking for office space, that could take some time too. Figure out the steps needed to get your business off the ground and add in an extra few months for good measure.

3. Consider your resources. Where are you going to get the money? Do you have any cash reserves? What about family or friends who might be willing to help out with a loan or a little bit of seed money? Do you have a business plan for the new venture? What about insurance and liability issues?

Mission Statement

Another element that should be presented in the business profile is the Mission Statement. When it comes to your business, a great mission statement can be the difference between success and failure. Here’s how to write a mission statement that will make your business thrive:

1. Keep it short and sweet. A great mission statement should be no more than a few sentences long.

2. Be clear and concise. Your mission statement should explain what your business does, what it stands for, and why it exists- all in a way that is easy to understand.

3. Make it inspiring. Your mission statement should motivate you and your team to achieve greatness. It should be something you’re proud of and excited to work towards.

4. Get input from others. Before finalizing your mission statement, get feedback from employees, customers, partners, and other stakeholders. They may have valuable insights that you hadn’t considered before.

The mission statement defines the current purpose of the business. It’s the ‘why’ of the business. It outlines the purpose of the business to those who are a part of the organization and your potential customers.

If you’d like more detail on how to write your business mission statement, check out this article.

Vision Statement

A vision statement is a key element of any business plan and it should be presented in the business profile section of your business plan. It is a brief statement that defines what you want your business to achieve in the future.

There are a few things to keep in mind when writing a vision statement for your business.

- Think about what you want your business to achieve. What are your long-term goals? What can you realistically achieve in the next five years?

- Keep it concise and clear. The vision statement should be no more than a few sentences. It should also be easy for people to understand.

- Review your vision statement regularly and update it as needed. As your business grows and changes, so too should your vision statement.

This article goes into more detail on how to write a great vision statement. It also gives some great examples.

Objectives

In order to have a successful small business, you need to have clear objectives. These should be covered in the business profile.

Here’s how to write them:

1. Know your audience. Before you can start writing objectives, you need to know who your target market is. This will help you determine what kind of language to use and what kind of objectives will resonate with them.

2. Keep it simple. Don’t try to cram too much into your objectives. Keep them short and sweet so that they’re easy to remember and understand.

3. Be specific. Vague objectives are not going to do anything for your business. Make sure each objective is something that can be measured so you’ll know whether or not you’re achieving it.

4. Make them achievable. It’s important to set goals that challenge you but are still achievable. These are specific goals you want to reach for your business. They should be specific, measurable, achievable, realistic and have a timeline.

Typical examples include financial, human resource and marketing goals. I like to keep the objectives to 3 per section in the business profile. The more narrow your focus, the more success you’ll have.

FREE Business Plan Template

Click to download the Classic Google Docs Business Plan Template

That's All Folks...

I hope with this information you are able to write the Business Profile section of your business plan. Up next…Business Philosophy.

If you have questions, please comment below and I’ll be happy to answer them.